Bandar Kinrara

Bandar Kinrara set to grow further

By Tan Ai Leng / theedgeproperty.com | September 25, 2015 11:44

AM MYT

By Tan Ai Leng / theedgeproperty.com | September 25, 2015 11:44

AM MYT

BANDAR Kinrara in Selangor is akin to the

piece of puzzle connecting Puchong, Selangor, and Bukit Jalil, Kuala Lumpur. Its easy accessibility and

affordability, especially in the early days of its development, have made it

popular among homebuyers.

BANDAR Kinrara in Selangor is akin to the

piece of puzzle connecting Puchong, Selangor, and Bukit Jalil, Kuala Lumpur. Its easy accessibility and

affordability, especially in the early days of its development, have made it

popular among homebuyers.

I&P Group Sdn Bhd, the master developer of Bandar Kinrara, started with

Bandar Kinrara 1 (BK1) in 1991 and gradually expanded up to Bandar Kinrara 9

(BK9).

Bandar Kinrara is strategically located 25km away from Kuala Lumpur city

centre and Cyberjaya, 30km away from Putrajaya and 8km from Bandar Sunway.

It can be accessed through the Shah Alam Expressway (Kesas), Bukit Jalil

Expressway, Lebuhraya Damansara Puchong (LDP), Maju Expressway (MEX), New Pantai

Expressway (NPE) and Jalan Puchong.

Early projects in Bandar Kinrara were mostly landed homes consisting

mid-range 1 and 2-storey houses. As the working population grew, non-landed

residences were introduced, especially low to medium-cost ones, including

Kenanga Apartment, Sri Tanjung Apartment and Merak Apartment.

Knight Frank Malaysia managing director Sarkunan Subramaniam describes Bandar

Kinrara as a well-planned integrated township, albeit with a conventional

design. It offers a mix of commercial shophouses within residential areas and

other amenities such as schools, recreational parks and places of worship,

making the area a comfortable place to live.

“A developer’s good reputation is also an assurance of capital appreciation.

It’s a highly populated township with a good sales and rental market,” he

says.

Great capital appreciation

In terms of capital appreciation, Michael Choy, senior real estate negotiator

of Reapfield Properties Sdn Bhd, says prices of some landed residential

properties in Bandar Kinrara have more than doubled from six years ago, while

high-rise properties are also seeing steady price growth in the past three

years. The hike in prices of landed homes has made high-rise properties more

attractive to homebuyers.

“As an example, a 2-storey house in Qaseh at BK8, with a size of 24ft by

70ft, is going for RM1.5 million!

“So, for people who can’t afford it, they may shift their focus to

high-rises, which are more affordable,” he says.

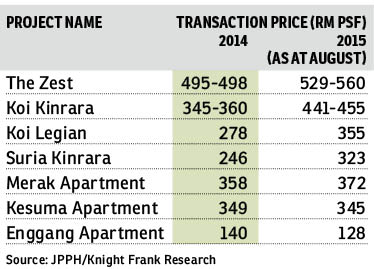

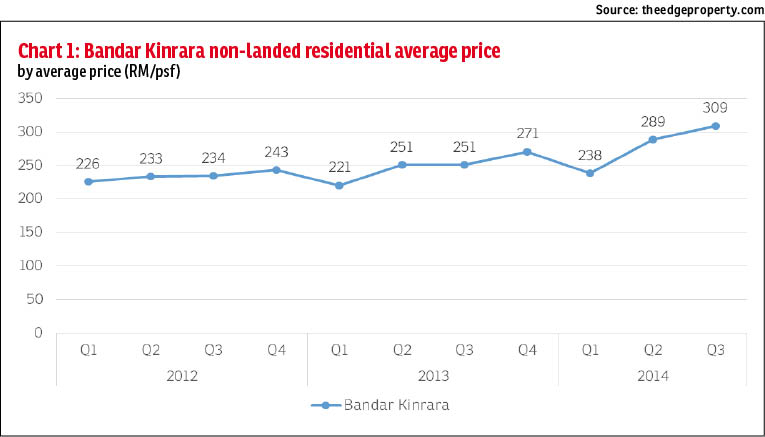

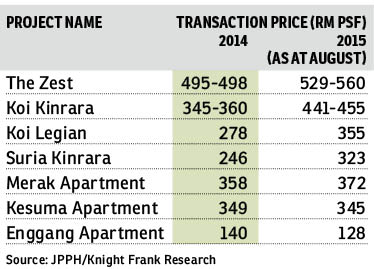

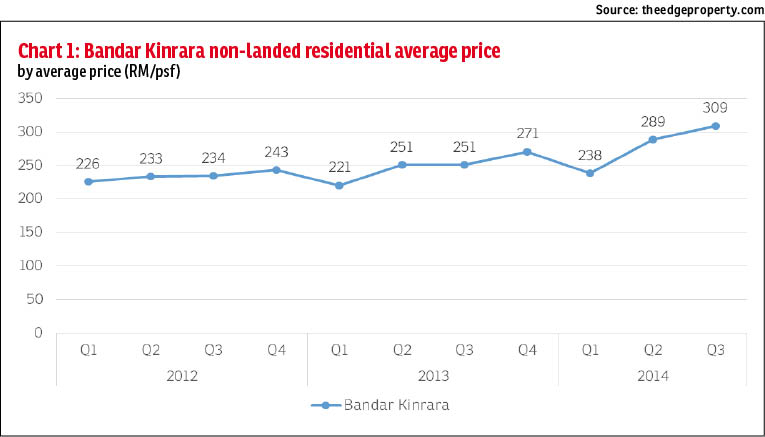

In an analysis of transactions of non-landed residential properties by

theedgeproperty.com covering areas from BK1 to BK9 as well as the neighbouring

areas of Taman Kinrara and Taman Bukit Kuchai, the average price in 2013 was

RM248.50 psf (pls confirm), compared with RM234 psf in 2012. As at 3Q2014, the

highest average transaction price recorded was RM309 psf.

“As an example, a 2-storey house in Qaseh at BK8, with a size of 24ft by

70ft, is going for RM1.5 million!

“So, for people who can’t afford it, they may shift their focus to

high-rises, which are more affordable,” he says.

In an analysis of transactions of non-landed residential properties by

theedgeproperty.com covering areas from BK1 to BK9 as well as the neighbouring

areas of Taman Kinrara and Taman Bukit Kuchai, the average price in 2013 was

RM248.50 psf (pls confirm), compared with RM234 psf in 2012. As at 3Q2014, the

highest average transaction price recorded was RM309 psf.

Choy

says there is demand for low and medium-cost apartments, especially those in the

price range of RM110 to RM380 psf, such as Enggang Apartment, with a built-up of

700 sq ft and selling for RM80,000, and Merak Apartment, with a built-up of 860

sq ft and selling for RM320,000, as shown in transactions in the past 12

months.

However, he notes that newer condominiums with facilities in the higher price

range of RM450 to RM600 psf are also seeing rising demand, resulting in strong

capital appreciation.

He cites as example the smallest units at The Zest in BK 9 with a built-up of

1,191 sq ft, which were selling for RM230,000 during the launch in 2008. One of

these units was sold for RM650,000 this year.

Incoming non-landed housing supply includes 8 Kinrara and Duet Residence. 8

Kinrara, an integrated development comprising retail and residential units by

I&P, was launched in 2013 at an average price of RM600 psf, according to

Choy. The project offers 35 storeys of residential units and shopoffices in one

block. It consists of 236 serviced apartments with built-ups of 623 to 2,483 sq

ft. The development is expected to be completed by 2018. Three storeys will be

allocated for shopoffices, and the rest will be residential units.

Duet Residence, which is located in BK6, is developed by Bandar Kinrara

Properties Sdn Bhd. The 1.91-acre project comprises two blocks — 23 and 21

storeys — with a total of 232 units. The built-ups are between 1,029 and 2,596

sq ft. Duet Residence is slated for completion by end of this year.

According

to Montprimo Sdn Bhd, the marketing agent of Duet Residence, the remaining 20%

of units for sale are now priced at an average RM635 psf, compared with RM500

psf during its launch in 2013.

Currently, there are only three parcels of vacant land left for residential

developments in Bandar Kinrara, which Choy says, may see I&P launch

additional blocks of serviced apartments near the Giant hypermarket and 8

Kinrara. The selling price is expected to be RM700 psf, he adds.

Knight Frank’s Sarkunan notes that the prices of low and medium-cost

apartments in Bandar Kinrara have been growing in tandem with the rise in prices

of new launches.

“The existing landed residential properties in the affordable range are

generally dated and require maintenance and renovations, which may increase the

cost for future buyers. Thus, current buyers are likely to look for high-rise

dwellings due to affordability issues as well as better returns,” he says.

TPE Realty negotiator Belinda Lim, who is familiar with the area, concurs.

“Most low to medium-cost high-rise homes here are freehold and less than 15

years old. This is one of the reasons homebuyers and investors are interested in

Bandar Kinrara’s high-rise properties.”

She says most condominiums and apartments are located in BK2 and BK3.

Property prices in newer areas, such as BK5 and BK6, are higher than in the

older areas such as BK1 to BK4.

In terms of rental yields, property agents concur that those who bought the

low to medium-cost apartments in Bandar Kinrara 5 to 10 years ago, have enjoyed

good yields. According to Choy, the rental yields are between 5% and 6%.

He notes that the rents of high-rise residences in Bandar Kinrara are mostly

below RM1,000 per month, and this is drawing strong interest from those looking

for affordable accommodation.

“It is easier to rent properties below RM1,000 [per month] due to

affordability and the rising cost of living. With a budget of around RM220,000,

investors can get a medium-cost unit and rent it out for RM850 [a month]. That

will generate a yield of around 5%, which is higher than fixed deposit rates,”

Choy explains.

Currently, the average monthly rent for older medium-cost apartments range

from RM600 to RM750, while newer ones are fetching RM1,000.

However, for new launches that exceed RM500 psf in price, Choy notes that the

rental yield will not be as attractive as the older ones.

Next growth catalysts

While Bandar Kinrara properties have experienced strong capital growth over

the years, Sarkunan says the price growth of high-rise residential properties is

expected to moderate due to incoming supply in and around the township. The

current tight financing conditions and uncertainties in the economy and property

market may affect price growth as well.

According to him, future supply, including projects under construction — Duet

Residences (233 units), 8 Kinrara (236 units) and The Linq at Kinrara Uptown

(684 units of serviced apartments) — are slated for completion by 2018.

In terms of rental yields, property agents concur that those who bought the

low to medium-cost apartments in Bandar Kinrara 5 to 10 years ago, have enjoyed

good yields. According to Choy, the rental yields are between 5% and 6%.

He notes that the rents of high-rise residences in Bandar Kinrara are mostly

below RM1,000 per month, and this is drawing strong interest from those looking

for affordable accommodation.

“It is easier to rent properties below RM1,000 [per month] due to

affordability and the rising cost of living. With a budget of around RM220,000,

investors can get a medium-cost unit and rent it out for RM850 [a month]. That

will generate a yield of around 5%, which is higher than fixed deposit rates,”

Choy explains.

Currently, the average monthly rent for older medium-cost apartments range

from RM600 to RM750, while newer ones are fetching RM1,000.

However, for new launches that exceed RM500 psf in price, Choy notes that the

rental yield will not be as attractive as the older ones.

Next growth catalysts

While Bandar Kinrara properties have experienced strong capital growth over

the years, Sarkunan says the price growth of high-rise residential properties is

expected to moderate due to incoming supply in and around the township. The

current tight financing conditions and uncertainties in the economy and property

market may affect price growth as well.

According to him, future supply, including projects under construction — Duet

Residences (233 units), 8 Kinrara (236 units) and The Linq at Kinrara Uptown

(684 units of serviced apartments) — are slated for completion by 2018.

“The existing and impending supply of high-rise residential units will create

a more competitive rental market that favours tenants. This may inevitably

reduce rental yields going forward, with tenants spoilt for choice,” says

Sarkunan.

He notes that stratified homes in neighbouring residential areas, such as

Bukit Jalil, Pinggiran Putra and Seri Kembangan, are competitively priced and

may put pressure on price growth as well.

“Some of the projects under construction, particularly those under the DIBS

(Developer Interest Bearing Scheme) where low downpayments were required for

property purchases, may see the soon-to-be-completed units put up for sale at

competitive prices amid the challenging property market conditions,” he

adds.

TPE Realty’s Lim is also cautious of the near-term price movement, especially

of the newer projects if market sentiment remains sluggish.

“The existing and impending supply of high-rise residential units will create

a more competitive rental market that favours tenants. This may inevitably

reduce rental yields going forward, with tenants spoilt for choice,” says

Sarkunan.

He notes that stratified homes in neighbouring residential areas, such as

Bukit Jalil, Pinggiran Putra and Seri Kembangan, are competitively priced and

may put pressure on price growth as well.

“Some of the projects under construction, particularly those under the DIBS

(Developer Interest Bearing Scheme) where low downpayments were required for

property purchases, may see the soon-to-be-completed units put up for sale at

competitive prices amid the challenging property market conditions,” he

adds.

TPE Realty’s Lim is also cautious of the near-term price movement, especially

of the newer projects if market sentiment remains sluggish.

“Investors who have purchased the apartments or condominiums five years ago

or earlier are enjoying good rental returns. However, for recent buyers, they

may face difficulties in getting tenants or the rent may be insufficient to

cover their monthly instalments,” she says.

However, Reapfield’s Choy says although transactions are few, demand remains

strong as the number of enquiries for Bandar Kinrara properties has not let up.

“People still want to buy, but affordability is their main concern.”

He notes that in terms of pricing, Bandar Kinrara tends to be a market

follower as it relied on growth in neighbouring townships, such as Puchong,

Bukit Jalil and residential areas along Jalan Puchong, for leads.

“Investors who have purchased the apartments or condominiums five years ago

or earlier are enjoying good rental returns. However, for recent buyers, they

may face difficulties in getting tenants or the rent may be insufficient to

cover their monthly instalments,” she says.

However, Reapfield’s Choy says although transactions are few, demand remains

strong as the number of enquiries for Bandar Kinrara properties has not let up.

“People still want to buy, but affordability is their main concern.”

He notes that in terms of pricing, Bandar Kinrara tends to be a market

follower as it relied on growth in neighbouring townships, such as Puchong,

Bukit Jalil and residential areas along Jalan Puchong, for leads.

“In

order to grow further, Bandar Kinrara needs new catalysts. The light rail

transit (LRT) extension project and Bukit Jalil City development could be the

drivers for future growth,” he says.

The LRT extension project for the Ampang Line, which starts from the Sri

Petaling station, passes through Kinrara before ending in Putra Heights. There

will be two stations in Bandar Kinrara — Alam Sutera and BK5.

The Alam Sutera station is located in between BK1 and BK9, about 10 minutes’

walk from The Zest, and the BK5 station is located in between BK2 and BK5, right

in front of the Giant hypermarket and 8 Kinrara. The distance from the two

stations is 3.5km.

Bukit Jalil City is just 5km away from these two locations. The 50-acre

integrated development, a collaboration between Malton Bhd and Kuala Lumpur

Pavilion Sdn Bhd, is slated for completion in 2019.

The project has four major components, including a two million sq ft Pavilion

Bukit Jalil shopping mall (also known as Pavilion 2) and The Park Sky Residence,

which comprises 1,098 serviced apartments, 444 units of 2 and 3-storey shoplots

and 3 and 5-storey retail offices. Although the market is cautious in the near

term, reflecting the current economic conditions, the real estate agents and

consultant believe that with good fundamentals, Bandar Kinrara’s maturity as a

residential development is well poised for the next phase of growth in the

future.

This article first appeared in The Edge Property

pullout, on Sept 25, 2015. Download The Edge Property for

free.

This article first appeared in The Edge Property

pullout, on Sept 25, 2015. Download The Edge Property for

free.

BANDAR Kinrara in Selangor is akin to the

piece of puzzle connecting Puchong, Selangor, and Bukit Jalil, Kuala Lumpur. Its easy accessibility and

affordability, especially in the early days of its development, have made it

popular among homebuyers.

I&P Group Sdn Bhd, the master developer of Bandar Kinrara, started with

Bandar Kinrara 1 (BK1) in 1991 and gradually expanded up to Bandar Kinrara 9

(BK9).

Bandar Kinrara is strategically located 25km away from Kuala Lumpur city

centre and Cyberjaya, 30km away from Putrajaya and 8km from Bandar Sunway.

It can be accessed through the Shah Alam Expressway (Kesas), Bukit Jalil

Expressway, Lebuhraya Damansara Puchong (LDP), Maju Expressway (MEX), New Pantai

Expressway (NPE) and Jalan Puchong.

Early projects in Bandar Kinrara were mostly landed homes consisting

mid-range 1 and 2-storey houses. As the working population grew, non-landed

residences were introduced, especially low to medium-cost ones, including

Kenanga Apartment, Sri Tanjung Apartment and Merak Apartment.

Knight Frank Malaysia managing director Sarkunan Subramaniam describes Bandar

Kinrara as a well-planned integrated township, albeit with a conventional

design. It offers a mix of commercial shophouses within residential areas and

other amenities such as schools, recreational parks and places of worship,

making the area a comfortable place to live.

“A developer’s good reputation is also an assurance of capital appreciation.

It’s a highly populated township with a good sales and rental market,” he

says.

Great capital appreciation

In terms of capital appreciation, Michael Choy, senior real estate negotiator

of Reapfield Properties Sdn Bhd, says prices of some landed residential

properties in Bandar Kinrara have more than doubled from six years ago, while

high-rise properties are also seeing steady price growth in the past three

years. The hike in prices of landed homes has made high-rise properties more

attractive to homebuyers.

“As an example, a 2-storey house in Qaseh at BK8, with a size of 24ft by

70ft, is going for RM1.5 million!

“So, for people who can’t afford it, they may shift their focus to

high-rises, which are more affordable,” he says.

In an analysis of transactions of non-landed residential properties by

theedgeproperty.com covering areas from BK1 to BK9 as well as the neighbouring

areas of Taman Kinrara and Taman Bukit Kuchai, the average price in 2013 was

RM248.50 psf (pls confirm), compared with RM234 psf in 2012. As at 3Q2014, the

highest average transaction price recorded was RM309 psf.

Choy

says there is demand for low and medium-cost apartments, especially those in the

price range of RM110 to RM380 psf, such as Enggang Apartment, with a built-up of

700 sq ft and selling for RM80,000, and Merak Apartment, with a built-up of 860

sq ft and selling for RM320,000, as shown in transactions in the past 12

months.

However, he notes that newer condominiums with facilities in the higher price

range of RM450 to RM600 psf are also seeing rising demand, resulting in strong

capital appreciation.

He cites as example the smallest units at The Zest in BK 9 with a built-up of

1,191 sq ft, which were selling for RM230,000 during the launch in 2008. One of

these units was sold for RM650,000 this year.

Incoming non-landed housing supply includes 8 Kinrara and Duet Residence. 8

Kinrara, an integrated development comprising retail and residential units by

I&P, was launched in 2013 at an average price of RM600 psf, according to

Choy. The project offers 35 storeys of residential units and shopoffices in one

block. It consists of 236 serviced apartments with built-ups of 623 to 2,483 sq

ft. The development is expected to be completed by 2018. Three storeys will be

allocated for shopoffices, and the rest will be residential units.

Duet Residence, which is located in BK6, is developed by Bandar Kinrara

Properties Sdn Bhd. The 1.91-acre project comprises two blocks — 23 and 21

storeys — with a total of 232 units. The built-ups are between 1,029 and 2,596

sq ft. Duet Residence is slated for completion by end of this year.

According

to Montprimo Sdn Bhd, the marketing agent of Duet Residence, the remaining 20%

of units for sale are now priced at an average RM635 psf, compared with RM500

psf during its launch in 2013.

Currently, there are only three parcels of vacant land left for residential

developments in Bandar Kinrara, which Choy says, may see I&P launch

additional blocks of serviced apartments near the Giant hypermarket and 8

Kinrara. The selling price is expected to be RM700 psf, he adds.

Knight Frank’s Sarkunan notes that the prices of low and medium-cost

apartments in Bandar Kinrara have been growing in tandem with the rise in prices

of new launches.

“The existing landed residential properties in the affordable range are

generally dated and require maintenance and renovations, which may increase the

cost for future buyers. Thus, current buyers are likely to look for high-rise

dwellings due to affordability issues as well as better returns,” he says.

TPE Realty negotiator Belinda Lim, who is familiar with the area, concurs.

“Most low to medium-cost high-rise homes here are freehold and less than 15

years old. This is one of the reasons homebuyers and investors are interested in

Bandar Kinrara’s high-rise properties.”

She says most condominiums and apartments are located in BK2 and BK3.

Property prices in newer areas, such as BK5 and BK6, are higher than in the

older areas such as BK1 to BK4.

In terms of rental yields, property agents concur that those who bought the

low to medium-cost apartments in Bandar Kinrara 5 to 10 years ago, have enjoyed

good yields. According to Choy, the rental yields are between 5% and 6%.

He notes that the rents of high-rise residences in Bandar Kinrara are mostly

below RM1,000 per month, and this is drawing strong interest from those looking

for affordable accommodation.

“It is easier to rent properties below RM1,000 [per month] due to

affordability and the rising cost of living. With a budget of around RM220,000,

investors can get a medium-cost unit and rent it out for RM850 [a month]. That

will generate a yield of around 5%, which is higher than fixed deposit rates,”

Choy explains.

Currently, the average monthly rent for older medium-cost apartments range

from RM600 to RM750, while newer ones are fetching RM1,000.

However, for new launches that exceed RM500 psf in price, Choy notes that the

rental yield will not be as attractive as the older ones.

Next growth catalysts

While Bandar Kinrara properties have experienced strong capital growth over

the years, Sarkunan says the price growth of high-rise residential properties is

expected to moderate due to incoming supply in and around the township. The

current tight financing conditions and uncertainties in the economy and property

market may affect price growth as well.

According to him, future supply, including projects under construction — Duet

Residences (233 units), 8 Kinrara (236 units) and The Linq at Kinrara Uptown

(684 units of serviced apartments) — are slated for completion by 2018.

“The existing and impending supply of high-rise residential units will create

a more competitive rental market that favours tenants. This may inevitably

reduce rental yields going forward, with tenants spoilt for choice,” says

Sarkunan.

He notes that stratified homes in neighbouring residential areas, such as

Bukit Jalil, Pinggiran Putra and Seri Kembangan, are competitively priced and

may put pressure on price growth as well.

“Some of the projects under construction, particularly those under the DIBS

(Developer Interest Bearing Scheme) where low downpayments were required for

property purchases, may see the soon-to-be-completed units put up for sale at

competitive prices amid the challenging property market conditions,” he

adds.

TPE Realty’s Lim is also cautious of the near-term price movement, especially

of the newer projects if market sentiment remains sluggish.

“Investors who have purchased the apartments or condominiums five years ago

or earlier are enjoying good rental returns. However, for recent buyers, they

may face difficulties in getting tenants or the rent may be insufficient to

cover their monthly instalments,” she says.

However, Reapfield’s Choy says although transactions are few, demand remains

strong as the number of enquiries for Bandar Kinrara properties has not let up.

“People still want to buy, but affordability is their main concern.”

He notes that in terms of pricing, Bandar Kinrara tends to be a market

follower as it relied on growth in neighbouring townships, such as Puchong,

Bukit Jalil and residential areas along Jalan Puchong, for leads.

“In

order to grow further, Bandar Kinrara needs new catalysts. The light rail

transit (LRT) extension project and Bukit Jalil City development could be the

drivers for future growth,” he says.

The LRT extension project for the Ampang Line, which starts from the Sri

Petaling station, passes through Kinrara before ending in Putra Heights. There

will be two stations in Bandar Kinrara — Alam Sutera and BK5.

The Alam Sutera station is located in between BK1 and BK9, about 10 minutes’

walk from The Zest, and the BK5 station is located in between BK2 and BK5, right

in front of the Giant hypermarket and 8 Kinrara. The distance from the two

stations is 3.5km.

Bukit Jalil City is just 5km away from these two locations. The 50-acre

integrated development, a collaboration between Malton Bhd and Kuala Lumpur

Pavilion Sdn Bhd, is slated for completion in 2019.

The project has four major components, including a two million sq ft Pavilion

Bukit Jalil shopping mall (also known as Pavilion 2) and The Park Sky Residence,

which comprises 1,098 serviced apartments, 444 units of 2 and 3-storey shoplots

and 3 and 5-storey retail offices. Although the market is cautious in the near

term, reflecting the current economic conditions, the real estate agents and

consultant believe that with good fundamentals, Bandar Kinrara’s maturity as a

residential development is well poised for the next phase of growth in the

future.

This article first appeared in The Edge Property

pullout, on Sept 25, 2015. Download The Edge Property for

free.

Comments

Post a Comment